Bluefin tuna – an iconic example for recovery

Bluefin tuna is known for its size and price. A new management strategy is to ensure the long-term sustainable management of the stocks in the Atlantic.

Oscillating between recession and resilience: investors should prepare for volatile capital markets in the new year. Actively managed equity investments in future issues offer interesting investment opportunities in a well-diversified portfolio. Whether in terms of crisis or euphoria, global macro trends will transform our world and thus also our behaviour. Among these trends, without doubt, is the topic of feeding the world population. A healthy, sustainably produced and resource-efficient protein like fish is likely to be one of the winners. We look back on an eventful 2022 and make 10 predictions for the new year. One thing is clear, however: the age of fish has just begun.

-Darrell Royal**

2022 was an eventful year, both for the fish & seafood sector and for the financial world. Issues such as the war on European soil, the aftermath of the pandemic, political power, inflation and interest rate hikes had an impact on the global economy and every single company functioning in it. In stock market terms, events surrounding Elon Musk's Twitter deal and record falls in Meta’s share price provoked furore and a frenzy of media attention. The past year has shown how "intertwined" our world is and that not everything about globalisation is positive.

Due to numerous macroeconomic challenges, several elements of uncertainty and high valuations at the beginning of the year, the global stock market indices moved predominantly in one direction – down. In particular, the long-celebrated tech stocks, which had also benefited from passive flows in past years, lost stock market value, in some cases massively. Companies in the fish and seafood sector were far removed from these developments.

Continuously growing demand for fish and seafood, the trend towards healthy eating and the slow return of HoReCa sales channels (Hotel/Restaurant/Catering) set good conditions for seafood investors to have a successful year. The supply shortage, also triggered by COVID, and simultaneous strong demand resulted in new record prices, among others for salmon. For operators of salmon farms such as Mowi or SalMar, this market environment was perfect for making healthy profits. Accordingly, the producers’ share price went through the roof in the first quarter, even though global markets were already suffering strong corrections at this point. During this turbulent period, Bonafide funds were able to position themselves clearly as outperformers offering positive returns.

The environment remained positive in the second quarter and for much of the third. Despite factors such as commodity inflation, higher energy prices and rising interest rates, companies were able to hold their ground. Fish are able to convert feed into body weight much more efficiently than other animal proteins. This led to a cost advantage in times of higher commodity inflation, as feed prices (input costs) increased less than proportionally. Stable balance sheets with relatively low debt helped against rising interest rates. Improved production processes helped companies to keep their energy costs low. Combined with a good outlook for the sector, this allowed seafood investors to sleep soundly. Bonafide funds continued to hold their ground with slightly positive returns.

However, the subsequent renewed downward trend of the stock markets also left its mark on the seafood universe and led to price drops. And at the end of September, there was another shock: the Norwegian government published a proposal to introduce a new 40% resource tax for aquacultures. This led to share price drops of up to 30% for the companies affected. More details can be found in this blog post. This has once again shown the importance of diversification within the portfolio.

The rest of the year can be rapidly summarised. The new tax was the subject of much discussion, some positive adjustments were made, and the portfolio's companies found themselves on the road to recovery. Finally, the industry's positive outlook for the future has not changed. The opportunities are manifold.

Looking to the future is much more important than looking back. Below, we venture 10 predictions for the new year and provide an overview of what awaits us.

We gaze into our crystal ball, from Norway to Chile and Japan. Numerous markets and seafood companies offer investment opportunities for the new year.

Food prices will remain high for the time being and further price increases have been announced. Many factors are changing the situation in agriculture and the food industry. The cost of energy, fertiliser and feed has risen sharply, while labour shortages and minimum wages are increasing labour costs. While consumption of certain animal and vegetable proteins will decline in 2023, we expect global fish consumption to remain stable or even increase slightly. This is partly due to more effective feed utilisation, which leads to a relative cost advantage and thus less pronounced price increases. In addition, the fish market offers products in all price categories: from basic food items to premium products such as salmon or yellowtail kingfish. About 65% of salmon is consumed in countries where, on average, people spend less than 15% of their income on food. This segment of the population demands high-quality food despite inflation – "people have to eat, even during crises".

A growing global demand for healthy, sustainable salmon will meet a limited supply. Norwegian farmers' reluctance to invest due to the announced tax hike, plus the still-present effects of the pandemic, will further tighten supply. Our analysts expect an average salmon price of NOK 85.00 [EUR 8.10] for the year 2023 (10-year average: NOK 60.00 [EUR 5.70]). This will lead to excellent margins. Regions like Chile in particular will also benefit from the new tax in Norway.

-Orjan Kjaervik Olsen, Country Manager for New Markets at the Norwegian Seafood Council

Current attractive valuations combined with good business performance will reward investors in the Chilean seafood sector with attractive double-digit dividend yields, just like last year. This, combined with the upside potential of the stocks, offers an excellent investment opportunity in a market that is yet to be discovered by many investors. In November of last year, our analysts visited numerous companies on site. This has further strengthened our positive impression.

The tug-of-war over the new tax will enter the next round in 2023. Producers have already been able to achieve a small win: the tax will be applied to actual income generated and not to a fixed price. This enables the conclusion of long-term sales contracts. A tax of 40% will lead to significantly higher tax revenues than the Norwegian government expects from the new tax. Opposition from coastal regions and an entire industry as well as the population at large is exerting powerful pressure on the government. We expect a compromise to be reached. This will allow all parties to save face: the government will receive additional tax revenues, companies will be able to forego further layoffs and the industry will continue to grow, as desired by all. We expect the tax rate to be halved to 20%. As stock prices have already priced in a worst-case scenario, this will open up new opportunities.

For a long time, the Japanese central bank acted as a bastion against rising interest rates – even after the interest rate turnaround in the US and Europe. But now the Japanese central bank has announced it will allow higher interest rates for long-dated bonds. A first, small step. We expect the yen to strengthen and to become less devalued against the USD. On the one hand, this will lead to currency gains, on the other, new money will flow into the market. This will lead to a re-rating of the multiples. Japan is and will remain one of the most important markets in the fish and seafood sector, and Japanese companies are broadly diversified. Investors in the Japanese seafood sector include Warren Buffett, a well-known face. And only recently, Berkshire Hathaway significantly increased its investments in Japan.

Improved margins, triggered by the lack of supply, will enable hybrid as well as fully land-based aquacultures to achieve positive operating cash flow. After the initial hype surrounding these new farming opportunities, many companies have been brought down to earth with a bump. Atlantic Sapphire ASA, for example, lost over 85% of its share value last year. If prices settle at a new level, profitable production is conceivable. However, this should not tempt investors to enter the sector without conducting detailed company analysis. A look at the company valuation as well as a detailed analysis of its future prospects will shed light on the situation.

Tighter regulation of fishing is showing results. Wild fish stocks are recovering, allowing companies to bank on a thriving business model for the future. The important thing is to learn from past mistakes and avoid repeating them. If we are successful in this, fishing quotas are likely to be increased over several years until a sustainable level of fishing is reached. The gradual nature of the increase is a blessing, as it allows existing capacities to be fully exploited. As wild fishing involves high fixed costs, the final percentage points of capacity are particularly lucrative. Only once these have been fully exploited is it necessary to invest in expanded capacity, but such expansions must be carefully planned. An example of such a species is the Chilean Jack mackerel.

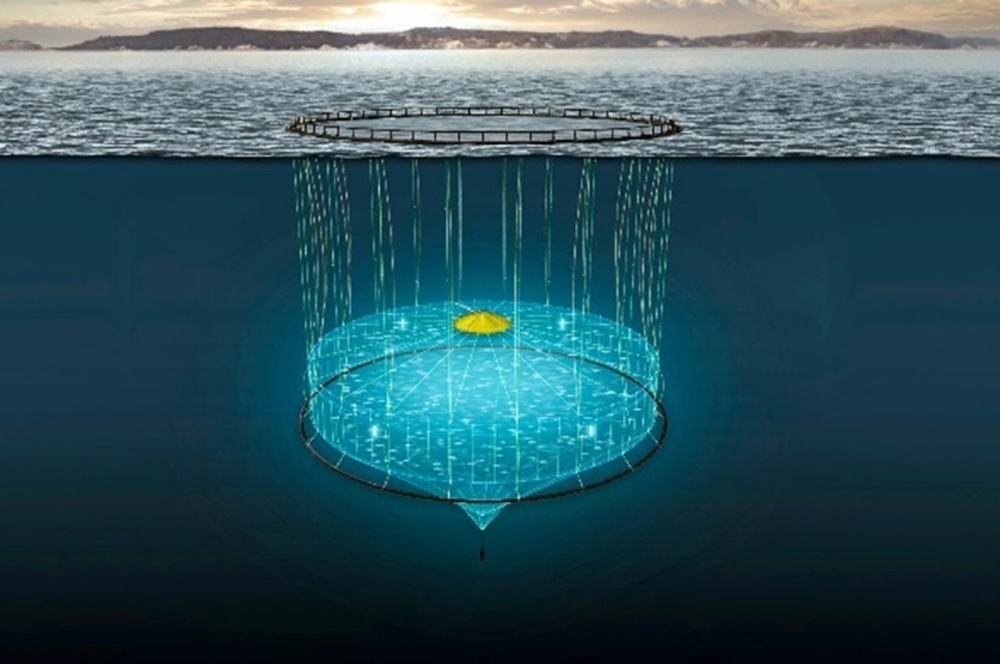

The Atlantis Subsea Faming farming project, launched by SinkabergHansen and the AKVA Group in 2018, is proving to be a success. Never before has salmon been kept at depths of between 20 and 60 metres below sea level for the entire production period. This new farming method has declared war on sea lice. At these depths, sea lice and diseases are less frequent and treatment becomes unnecessary. This offers enormous advantages, both environmentally and economically. After the proof of concept, we expect the market breakthrough to happen in 2023.

Seaweed is very much in vogue. We are eating more of it every year, and not only in the countries of the Far East, where there is a very strong tradition of foods containing algae. Algae consumption is also continuously increasing in Europe. To date, it is still mainly wild seaweed that is being harvested here. But that is about to change: the “EU Algae Initiative” aims to take a holistic approach to the algae sector. It defines 23 measures intended to create opportunities for the algae industry to grow into a sustainable, regenerative sector capable of meeting the growing demand in the EU. Algae products are already widely used for cosmetics, pharmaceuticals and energy production. Algae of various types can also be used as biofuel or bioplastics, as well as in agriculture. We expect another significant increase in demand in 2023. One of our portfolio companies that is dedicated to algae is Tao Kae Noi.

It is undeniable that 2022 has brought challenges and uncertainties throughout the world of investment. However, we are optimistic about the fish and seafood industry's progress, as well as its future. Globally, a revolution is taking place beneath the surface of the water. Although many are not yet aware of it, better technologies, improved production processes and targeted investments in aquaculture are heralding a future that will bring greater food security, higher incomes for farmers, healthy and tasty proteins for millions of people, a positive balance sheet in terms of protecting the environment and fighting climate change, and great investment opportunities.

Bonafide Global Fish Fund EUR: -2.25%

Bonafide Global Fish Fund EUR -A-: -2.25%

Bonafide Global Fish Fund CHF: -5.59%

Bonafide Global Fish Fund CHF -A-: -5.33%

Bonafide Global Fish Fund USD: -5.22%

Bonafide Investment Fund – Best Catches: +7.03%

Bonafide Investment Fund – HBC I: -53.15%

Bonafide Investment Fund – HBC II: -52.50%

Bonafide Investment Fund – Opportunities I: +10.40%

Comments