Bluefin tuna – an iconic example for recovery

Bluefin tuna is known for its size and price. A new management strategy is to ensure the long-term sustainable management of the stocks in the Atlantic.

Due to several enquiries about the geopolitical situation in Eastern Europe, we would like to inform you about our exposure in this region.

Our fund products hold no equity investments in Russian or Ukrainian companies. Therefore the unsightly activities of war, depicted by the media on a daily basis through images of destroyed buildings and facilities, will not affect the portfolio’s net asset value.

The indirect effects of the war include the fact that two sales markets for certain product categories have disappeared for the moment. Russia, with a population of 140 million, is being isolated from the global economy through export sanctions and voluntary supply waivers. Ukraine, with a population of more than 40 million, is more likely to demand long-life canned foods than perishable goods now that war has broken out. Cumulatively, these two populations represent 2.3% of the world's population.

Ukraine and Russia are also large exporters of commodities, including wheat. Commodity prices have therefore risen further due to fears and speculation about decreased supply from Eastern Europe.

Wheat is one of several components of feed in the food industry and thus also in aquaculture. This will further increase cost pressure for producers in the short and medium term.

Thirdly, the war in Ukraine and the sanctions against Russia are increasing logistics costs for procurement and distribution. Transport ships and aircraft have been barred from accessing large areas and some trading ports. Longer distances and new trade routes increase transport costs.

The entire food industry, and ultimately the end consumer, are affected by the aforementioned circumstances. The population of Russia and Ukraine will continue to consume basic foodstuffs; the question is which foodstuffs will be available at which prices and which will not. Companies will try to compensate for higher costs through productivity gains and, sooner or later, will pass the costs on to consumers. Food expenditure will rise noticeably in many households over the coming months and years.

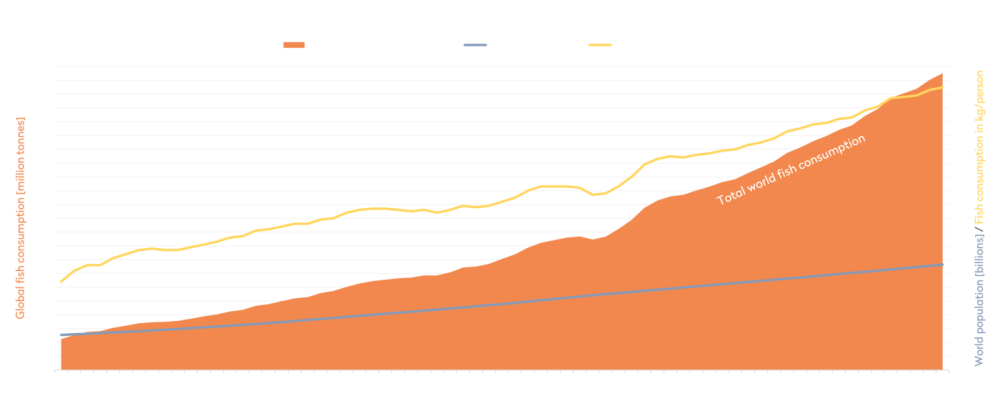

The war in Ukraine is to be condemned in the strongest pos-sible terms. However, it does not change the fact that the world’s growing population needs to feed itself every day in order to stay alive. Combined with the consumption trend towards a balanced diet (which contains more healthy fish proteins than the average world citizen consumes), these two growth pillars have supported the Fish & Seafood sector since the beginning of industrialisation.

Since the late 1980s, global wild fish stocks have been fished at the maximum possible annual yield. Any additional growth in supply since this point has come from aquaculture. The growth in demand is expected to continue at an unchanged pace thanks to rising populations and the growing global middle class. However our analyses show that for some fish species, the growth in supply cannot keep pace. This will inevitably lead to higher prices for fish-based proteins. Higher sales prices should more than compensate for increased feed and logistics costs.

According to the FAO's Food Price Index, food prices have risen by 20.7% to a new all-time high in the last

12 months. Consequently, companies should find it easy to push through price increases.

Thanks to more efficient feed conversion, some fish species also enjoy a relative cost advantage. In financial terms, commodity inflation hits the production of less efficient meat proteins such as pork or beef much harder. Meat producers have to raise sales prices much more than salmon farmers, for example.

In the real economy, market forces have already caused a significant rise in some fish prices. The price of salmon reached a new all-time high of NOK 90/kg at the beginning of February. In the financial market, transfixed by the war in Ukraine, the new reality seems to be slow to arrive. Moreover, few market participants have ever experienced periods of high inflation like this one. In the current environment, pessimism about higher costs may prevail in the short term, but sooner or later the improved long-term prospects with new record prices will become evident. A handful of seafood analysts from well-known banks are at least beginning to revise their long-overdue price estimates upwards. This is in contrast to the downward revision of earnings growth estimates in other sectors and global stock indices. The relative strength of our sector, evident since the beginning of the year, is therefore likely to continue for some time.

-Christoph Baldegger, founder of Bonafide

Comments