The Investment Process

Our Investment Committee

The Research and Portfolio Management departments are responsible for the structuring and implementation of the investment process. The Investment Committee, which is convened by the Management Board on a product basis, approves changes to the process. Furthermore, the committee defines the framework conditions and monitors compliance and risk parameters. Documentation is provided in the form of protocols of the Investment Committee meetings. The operational tasks are fully delegated to the Research and Portfolio Management departments. The Executive Board itself sits on the Investment Committee.

Philipp Hämmerli

Chief Investment Officer (CIO)

Philipp Hämmerli

Chief Investment Officer (CIO)

Professional experience:

Philipp Hämmerli is the managing director responsible for the portfolio management and research team. Before joining Bonafide in spring 2018, he worked for Liechtensteinische Landesbank (LLB) in the institutional clients business for five years. His main activities included advising fund clients on banking, stock market and fund-related topics. His entry into finance began in 2007 with a classical banking apprenticeship. His affinity for the world markets intensified as a junior trader for a Swiss regional bank, where he dedicated himself to the execution of stock exchange and foreign exchange transactions, refinancing and liquidity management, among other things. He holds a bachelor's degree in banking & finance from the Zurich University of Applied Sciences.

Key competencies & experience:

Expert in financial analysis of companies, especially in the fish & seafood universe. Several years of experience with fund structures, especially the versatile duties of fund custodianship. Broad specialist knowledge in trading in securities, foreign exchange and money market transactions.

Marco Berweger

Chief Operating Officer (COO) / Sales Manager

Marco Berweger

Chief Operating Officer (COO) / Sales Manager

Beruflicher Werdegang:

Marco Berweger ist Chief Operating Officer (COO) bei Bonafide Wealth Management AG und leitet das Marketing- und Sales-Team. Nach seiner kaufmännischen Ausbildung bei einer Schweizer Regionalbank sammelte er von 2014 bis 2020 umfassende Erfahrungen in den Bereichen Kundenberatung, Anlageberatung, Marketing, Compliance, Assistenz der Bankleitung und Nachwuchsentwicklung. Marco besitzt einen Master in Banking & Finance mit Schwerpunkt Capital Markets and Data Science von der ZHAW School of Management and Law. Zuvor erwarb er den Titel eines Betriebsökonomen FH.

Schlüsselkompetenzen/Erfahrung:

Marco ist ein erfahrener und kompetenter Finanzexperte mit starkem Kommunikations- und Führungstalent. Er überzeugt durch innovative Marketingstrategien und erfolgreiche Wachstumsprojekte. Sein unternehmerisches Denken und seine Fähigkeit, Teams zu leiten und zu entwickeln, machen ihn zu einer wertvollen Führungskraft.

Christoph Baldegger

Board Member

Christoph Baldegger

Board Member

Professional experience:

Christoph Baldegger is a founding member and a member of the Board of Directors at Bonafide. From 2004 to 2008, he was a member of the executive team of a private equity firm, jointly responsible for developing tangible asset investments in sectors such as fish farming, farmland, and timber. From 1998 to 2004, he lent his expertise in research, corporate development, consulting, and as a fund manager at various Swiss private banks. From 1990 to 1998, he worked as an investment banker in Switzerland and London. Subsequently, he took the leap into self-employment and founded Bonafide. For many years, he worked in sales and was also a part of the Investment Committee. Christoph Baldegger is a Certified European Financial Analyst (CEFA).

Key competencies & experience:

Experience in aquaculture and fisheries; participated in the FBA Aquaculture Course for fish farming; holds his own fishing license; international industry experience; development of aquaculture in South America; leadership and marketing skills; development of Bonafide and launch of the Bonafide Global Fish Fund.

Marco Fiorini

Chief Executive Officer (CEO)

Marco Fiorini

Chief Executive Officer (CEO)

Professional experience:

With over 20 years of experience in the Swiss finance and asset management industry, Marco Fiorini has built an impressive track record in sales, business development, and management roles. His expertise in negotiations, international and jurisdictional know-how, and the development of long-term business partnerships has enabled him to establish a robust network of clients in Switzerland, including family offices, distribution platforms, banks, and asset managers.

Key competencies & experience:

Marco Fiorini is an experienced Global Key Account Manager in the financial industry. His skills span sales and business development, where he has successfully managed complex relationships with various stakeholders, particularly major Swiss banks and international platforms. He consistently takes into account the individual needs of his clients and achieves their objectives. Additionally, Marco possesses extensive expertise in investment strategies, including long-term equity and bond strategies, Absolute Return strategies, and alternative investments. This enables him to adapt flexibly to the requirements of different clients and fulfill their financial goals. Through his results-driven approach and teamwork, Marco has built strong and enduring relationships with clients. His ongoing interest in financial markets and asset management drives him to continually seek new opportunities to foster growth and cultivate long-lasting client relationships.

Jean-Dominique “JD” Bütikofer

Chairman of the Board

Jean-Dominique “JD” Bütikofer

Chairman of the Board

Professional experience:

J.-D. Bütikofer, CFA, is a seasoned Non-Executive Board Member and investment advisor with a robust career spanning over three decades in the financial industry. He currently holds a mandate with Bonafide Wealth Management AG and serves on the Board of Atlantic Forfaiting Company Ltd, a Swiss asset management firm specializing in Emerging Markets private debt investments. His extensive experience includes senior roles at regulated asset managers and banks across Switzerland, the EU, and the USA. From 2014 to 2022, he was the Head of Emerging Markets Fixed Income at Voya Investment Management in Atlanta, USA. He joined Atlantic Forfaiting in Fall 2022 and Bonafide in Spring 2024. Additionally, he advises mid-sized financial firms, SMEs, investment funds, and multi-family offices on investment strategies and capital raising solutions.

Key competencies & experience:

Jean-Dominique Bütikofer holds a Master's degree in Economics from the University of Neuchâtel, Switzerland, and is a CFA Charterholder. He is fluent in English, French, German, and Spanish, which complements his ability to navigate international financial markets. His expertise lies in emerging markets, global fixed income, currencies, and public and private credit debt markets, with a proven track record in investment management and advisory roles. His strategic insights and advisory capabilities have benefited numerous financial institutions, enabling them to achieve their investment goals and optimize capital-raising efforts.

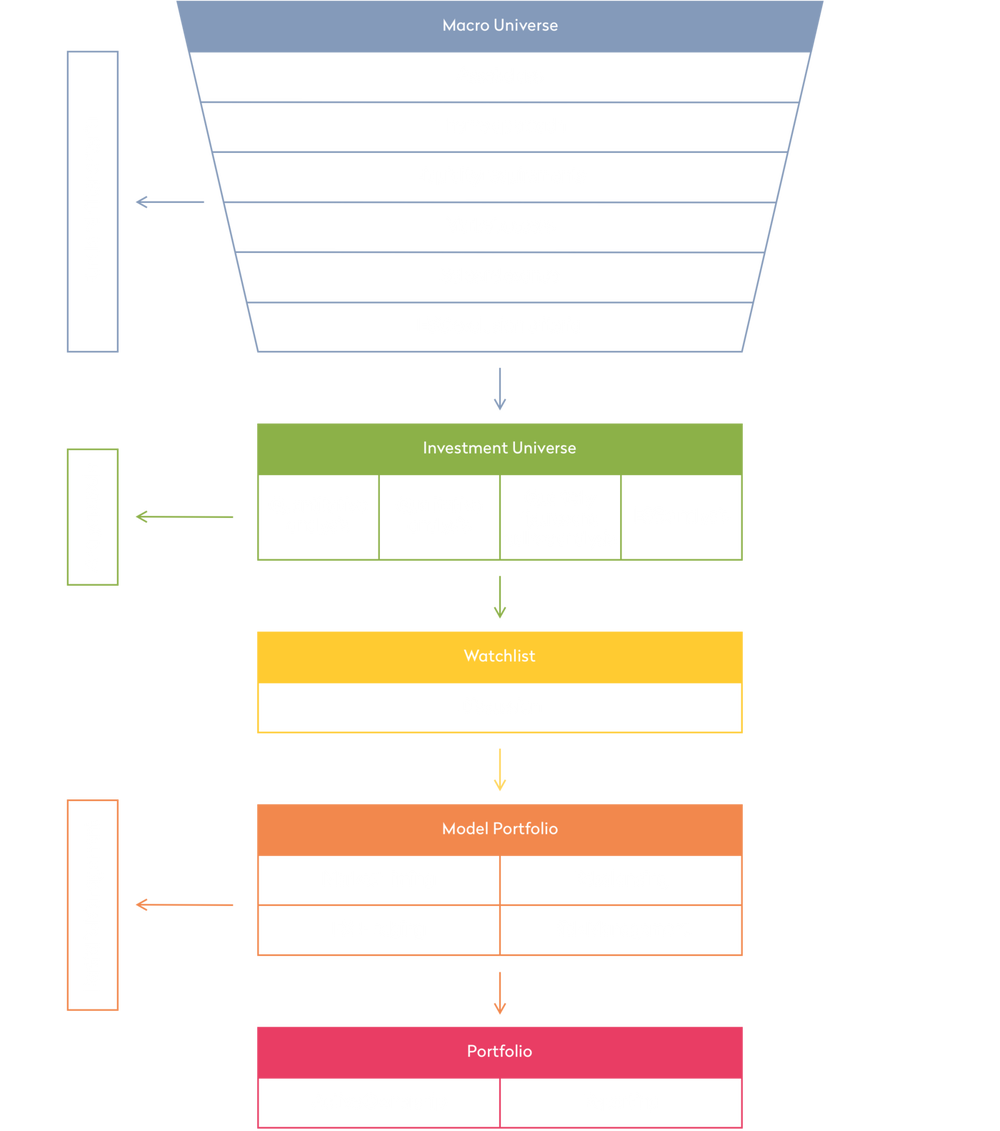

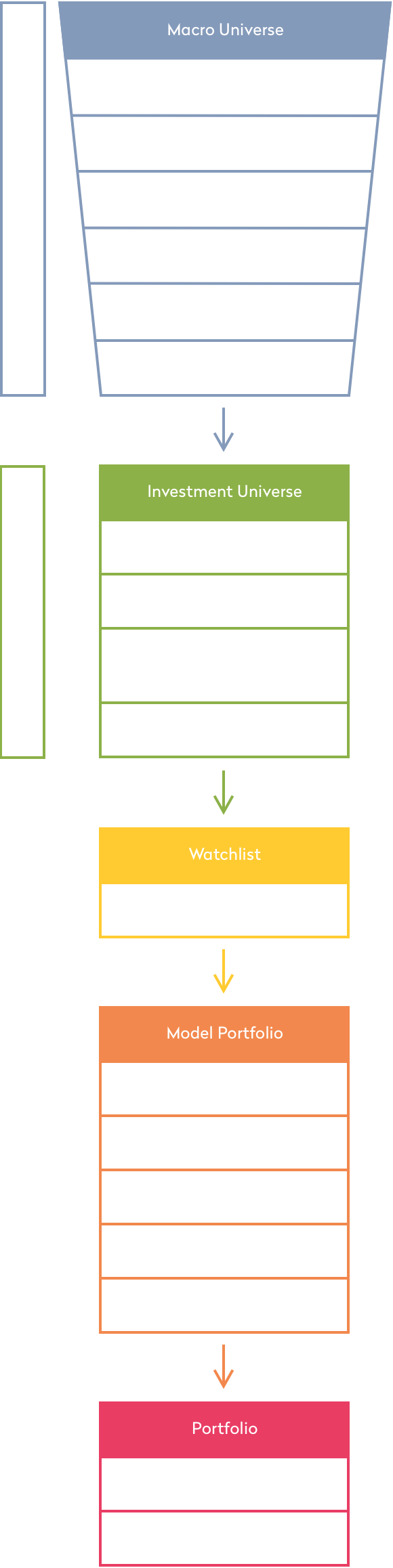

Systematic investment process

The thematic focus within our investment approach allows us to see completely different perspectives than the average investor is likely to. Our macrouniverse is flooded with knowledge and news every day , whether through newsfeeds from the industry, the financial market or through our broad network that we have been building and maintaining for over 10 years.

The central task which drives the day-to-day work at Bonafide is to process this knowledge and to draw the right conclusions from it. The sector catalogue we have developed in-house divides companies into their respective roles within the supply chain. It enables us to carry out evaluations and comparisons of specific companies with a level of differentiation that global data providers are unable to provide.

Our systematic investment process sorts the macrouniverse using filter criteria, resulting in an investable investment universe ready for further analysis. Our financial specialists then devote themselves to quantitative and qualitative analyses, which, in particular, also critically assess the sustainability aspects of the company.

Once again, the network we have built up over the years helps us enter into dialogue with people, managers, analysts, and companies and ask the right questions. By meeting on a regular basis, we ensure that opportunities are seized and carefully analysed from different perspectives.

Portfolio management then makes the investment keeping a close eye on risk parameters. We are regularly accountable to our investors and are happy to explain our concepts and activities in person upon request.

We search. We filter. You invest.