Chile and its political stock market

In this blog we will use Chile to take a closer look at a stock market currently influenced by political fears. Where uncertainty reigns, the patient investor can usually find opportunities.

Global equity investors with the euro as their reference currency are experiencing what Swiss franc investors have been going through for years: a strong domestic currency eating away at the price gains of securities abroad. Investing locally is not a solution, as companies operating globally are just as exposed to exchange rate risk in terms of sales and profits. Where there are dangers, there are also opportunities. Now is the time to analyse the currency allocation of the fish strategy.

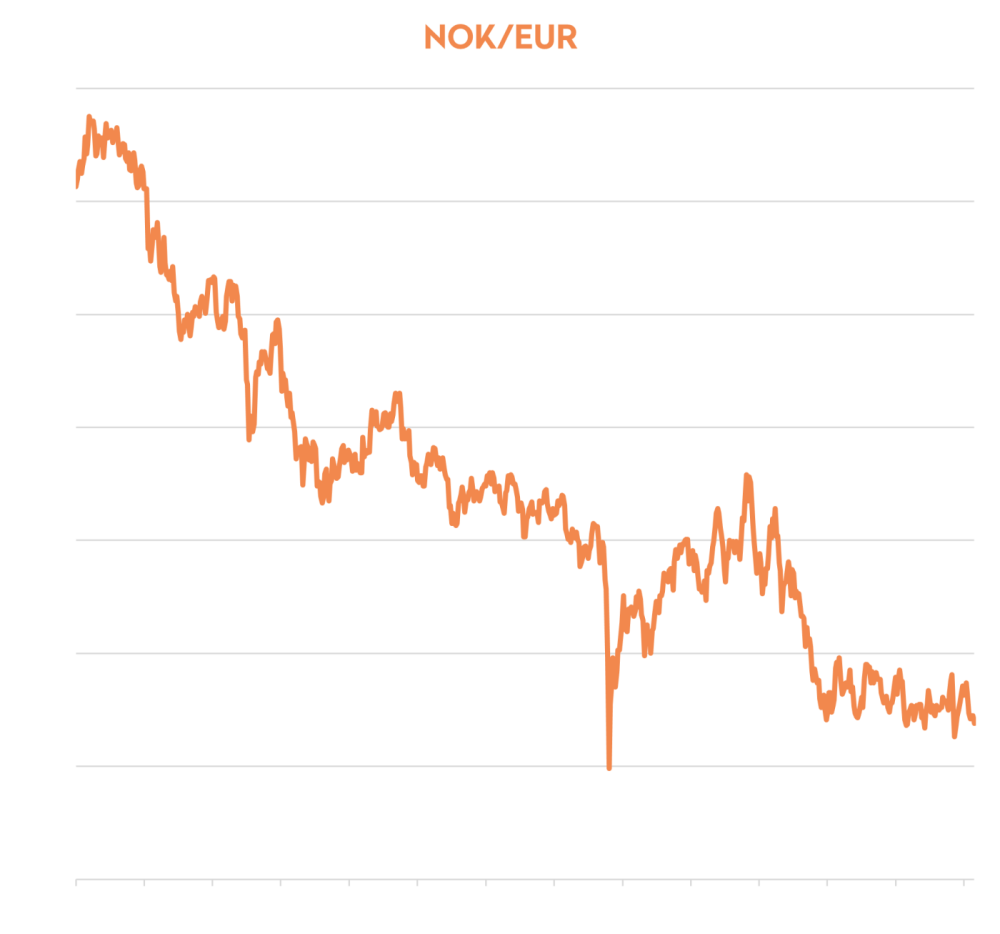

Thanks to its oil fund, which now stands at USD 2 trillion or USD 340,000 per capita, Norway has an enormous capital reserve that grows annually thanks to a risky long-term investment strategy abroad. Even the partial distribution to the state to cover the structural deficit does not come close to making a dent in the fund's size. Despite this wealth, the Norwegian krone has steadily depreciated against the euro by over 20% since 2022 — double the rate since the 'fish strategy' was launched in 2012. Financial markets are therefore unhappy with this excessive fiscal policy. The policies of the left-wing government, which has been in power since 2021, do little to inspire confidence, with measures such as introducing the salmon tax and wealth tax in 2022. The exodus of Norwegian millionaires and billionaires abroad to save their businesses would be reason enough for a change in political course. On 8 September 2025, Norway will elect a new parliament – could this be a turning point for the krone?

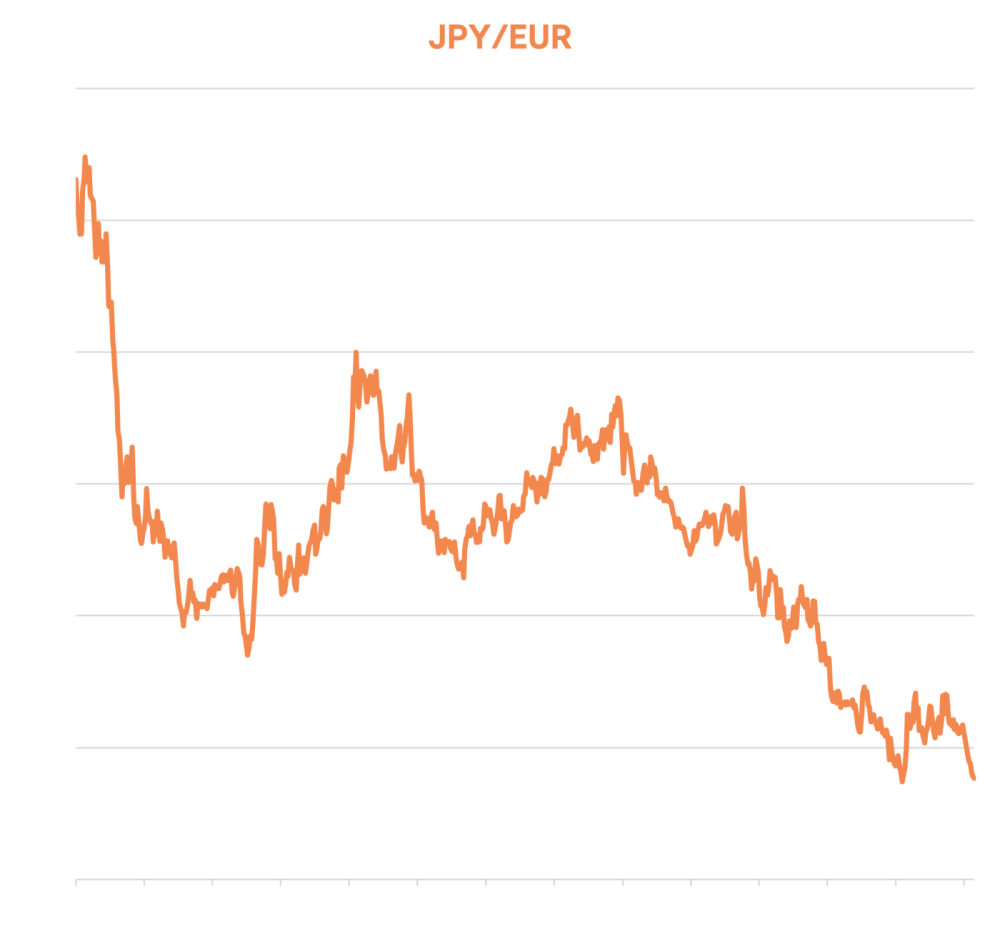

According to the purchasing power parity model, which uses producer prices, the yen is currently undervalued by over 50%. This makes the currency of the world's fourth-largest economy attractive. The summer of 2024 demonstrated how swiftly counter-movements can occur when the JPY appreciated by 10% within 14 days. Numerous carry trades were caught off guard by an interest rate hike from the Bank of Japan. Nevertheless, the JPY has lost over 25% of its value since the end of 2021, and as much as 40% against the euro since 2012. Japan tops the list of major economies with the highest public debt ratio, at around 240% of GDP depending on the source. In a phase such as the current one, where further interest rate hikes are anticipated, this poses a risk to the budget deficit. What is unfortunately often overlooked is that the state also has substantial investments at the consolidated level. A recent analysis by the St. Louis Fed showed that net debt amounts to only 78% of GDP. Japan's long-standing low interest rate environment has enabled institutions to generate high returns while interest costs have remained modest. This has limited the government's deficit. The Japanese are not to be underestimated.

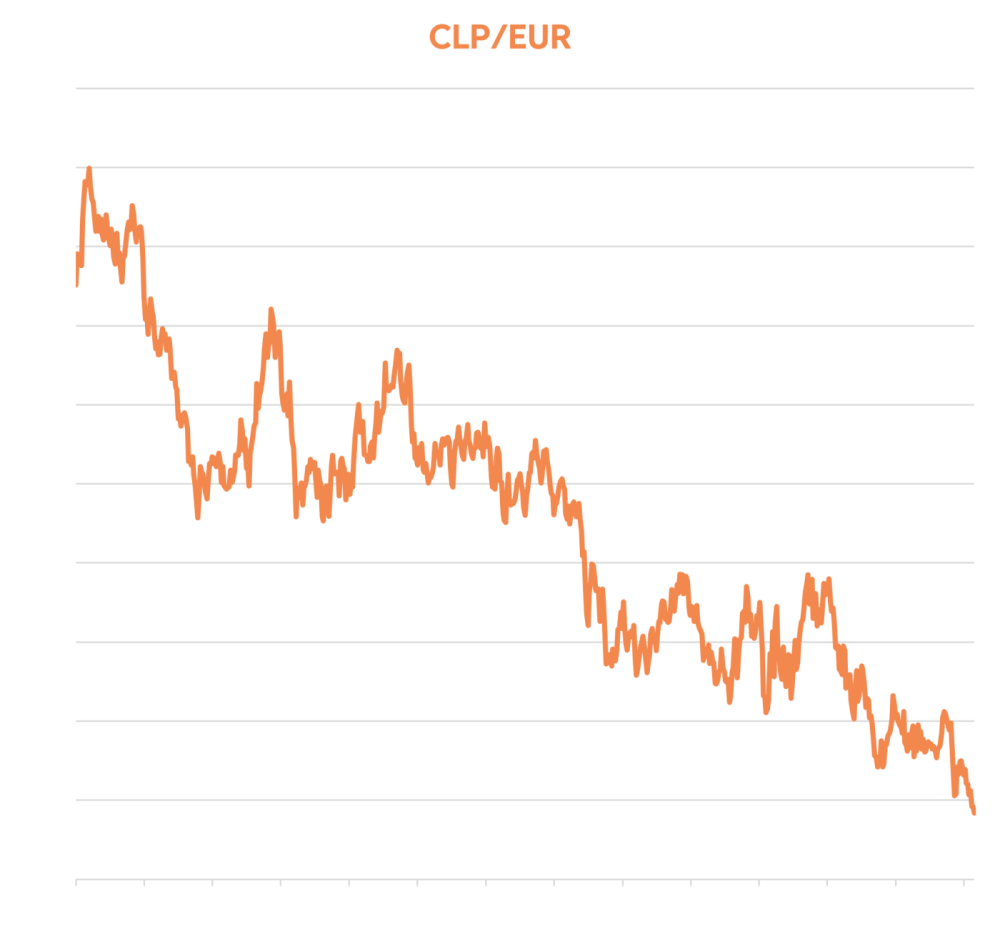

The development of the Chilean peso has been particularly unusual in recent times. But let's start at the beginning. South America's strongest economy experienced a slowdown in growth from 2015 onwards. Higher taxes on companies led to a decline in private investment, putting pressure on wage growth. Increased crime due to immigration from Venezuela, coupled with rising metro prices in Santiago de Chile, led to violent riots in 2019/2020, resulting in political upheaval. Having taken office with revolutionary promises, left-wing President Boric's term was unsuccessful. A new constitution was rejected by voters twice, but Chile is now returning to the moderate centre. There is a new consensus that the 2014 tax reform stifled prosperity. Accordingly, several presidential candidates are campaigning for tax cuts. Elections will be held in December 2025, and together with the resurgence of private investment, they could mark a turning point for the peso. The peso's record low against the euro (-40% since 2012, -9% year to date) also seems fundamentally unjustified. Chile is growing and has abundant resources and a low debt ratio of less than 45% of GDP.

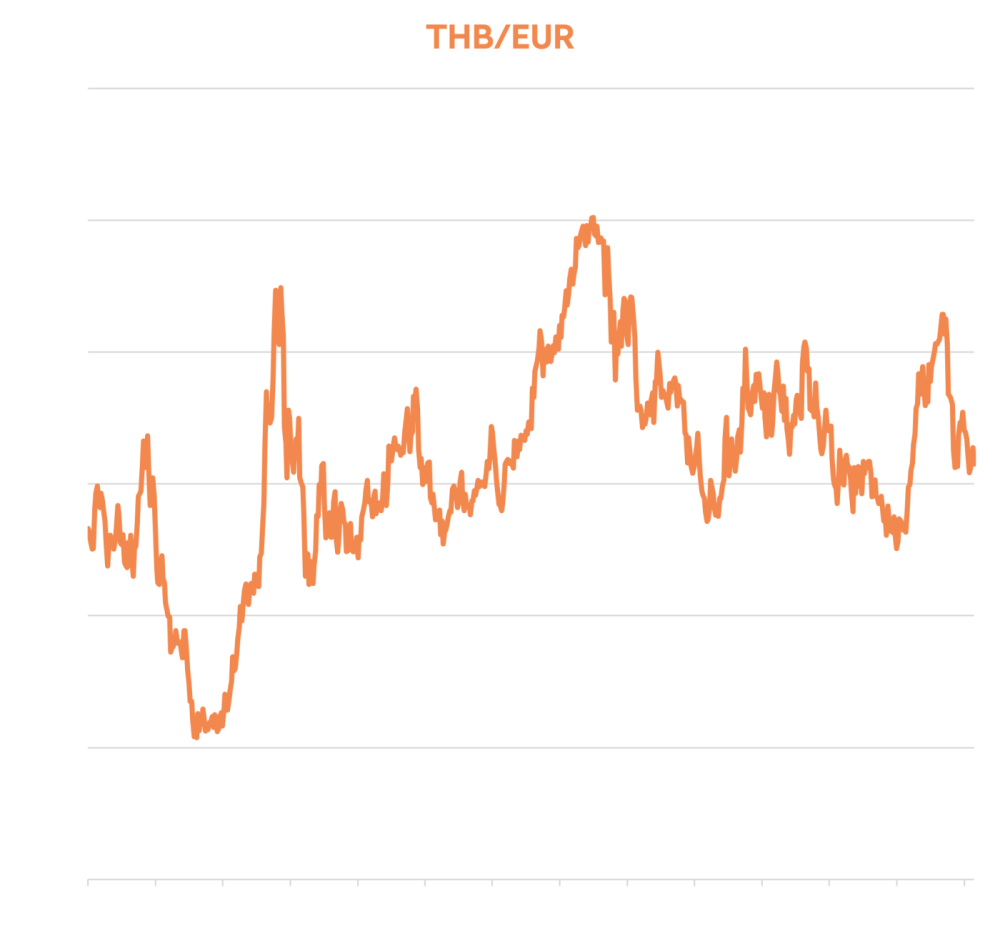

Perhaps surprisingly for an Asian currency, the Thai baht has remained stable over the long term. Currently, Thailand's currency is trading at the same level against the euro as in 2012. During this period, there were phases of appreciation and depreciation of up to 15%. Despite occasional conflicts, such as the recent one on the border with Cambodia, and political turmoil, Thailand, a country heavily dependent on tourism, has succeeded in creating stable conditions for foreign investors. Moderate inflation and debt, as well as structural trade surpluses, are positive factors. However, Thailand's weakness is evident in the profit performance of the 50 largest listed companies. Since their record year in 2018, their aggregate profits have fallen by 30%. Much of this decline is occurring at the sectoral level, with domestic production being replaced by cheap imports from China. Currently, the outlook for the Thai baht is unclear. Export-oriented companies, such as those in the fish and seafood sector, would benefit from a devaluation.

Three of the four currencies with the largest allocations in the fish strategy have tended to be undervalued, a tendency that became even more pronounced in the first half of 2025, offering opportunities. While there is talk of a global debt crisis, countries in a much better position are not experiencing any capital inflows. The double irrationality of the financial markets is evident when currencies and the shares of export-oriented companies depreciate simultaneously. A weaker currency makes products more attractive abroad while manufacturing costs locally remain unchanged. This results in higher profits in local currency, albeit with a delay. Anyone who believes they can avoid currency risk with a broadly diversified equity ETF is mistaken. It is this total ignorance of risk that continues to drive global stock market indices, while niche markets remain attractively valued. Accordingly, opportunities exist not only in share prices in the fish and seafood sector, but also in currency gains. Rationality is required.

Comments